EP82 个人养老金实施两年了,观望/开通/存钱/买产品,你到哪一步了?

保持通话

Deep Dive

What are the key benefits of opening a personal pension account?

The key benefits of opening a personal pension account include tax savings and the ability to build a retirement fund. Contributions to the account can be deducted from taxable income, potentially saving between 360 to 5400 yuan annually depending on the individual's tax bracket. Additionally, the account serves as a disciplined way to save for retirement, with funds growing tax-deferred until withdrawal at retirement age.

How many people have opened personal pension accounts in China?

Over 60 million people have opened personal pension accounts in China. However, a significant number of these accounts remain unfunded, with many individuals not yet contributing money or purchasing products within the accounts.

What types of products are available in personal pension accounts?

Personal pension accounts offer four main types of products: pension deposits, pension funds, pension wealth management products, and pension insurance products. As of November, there are over 800 products available, including more than 400 pension deposits, around 200 pension funds, 26 pension wealth management products, and 144 pension insurance products.

What is the maximum annual contribution to a personal pension account?

The maximum annual contribution to a personal pension account is 12,000 yuan. This amount can be adjusted based on an individual's financial situation, with no minimum contribution required.

What is the tax rate applied when withdrawing funds from a personal pension account?

When withdrawing funds from a personal pension account at retirement age, a 3% tax is applied on the total amount withdrawn. This tax is part of the tax-deferred benefit, where contributions are deducted from taxable income upfront.

Who is the target audience for personal pension accounts?

The target audience for personal pension accounts includes individuals with a need for tax savings and those who are planning for retirement. It is particularly beneficial for middle to high-income earners aged 30 to 50, as they can achieve significant tax savings and have a clearer retirement planning goal.

What are the main challenges with personal pension accounts?

The main challenges with personal pension accounts include the lack of flexibility, as funds cannot be withdrawn until retirement age, and the complexity of choosing from over 800 available products. Additionally, many people open accounts but do not contribute funds or purchase products, limiting the benefits they can receive.

How does the personal pension account compare to commercial pension insurance?

The personal pension account offers tax advantages and is designed specifically for retirement savings, with funds locked until retirement age. In contrast, commercial pension insurance provides more flexibility in terms of when benefits can be accessed and may offer additional features like death benefits or guaranteed payouts. However, commercial pension insurance does not offer the same tax-deferred benefits as personal pension accounts.

What is the expected retirement savings from a personal pension account?

If an individual contributes the maximum 12,000 yuan annually for 20 years with an average annual return of 3%, they can expect to accumulate around 320,000 yuan by retirement. Higher returns, such as 4%, could increase this amount to approximately 356,000 yuan, though these are ideal scenarios.

What are the key considerations for young people when deciding whether to open a personal pension account?

Young people should consider their current financial stability, long-term retirement goals, and the flexibility of their funds before opening a personal pension account. Since the account locks funds until retirement, it may not be suitable for those who anticipate needing access to their money in the near future. Additionally, young individuals should evaluate whether the tax savings and retirement benefits align with their financial priorities.

- 超过6000万人开立个人养老金账户

- 开而未缴和缴而未买的情况普遍存在

- 目前共有800多种产品,四类产品共计800多种

Shownotes Transcript

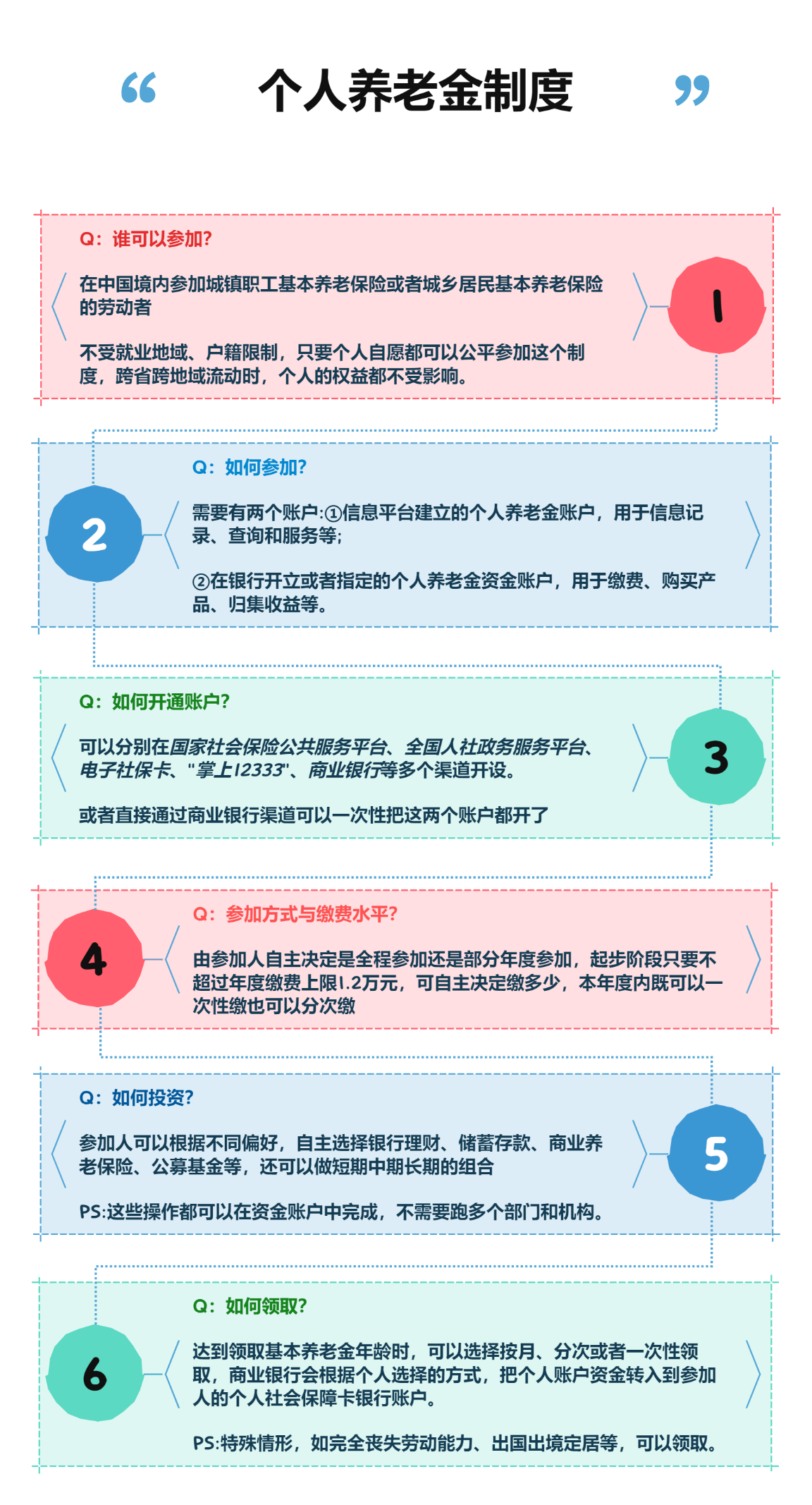

这期节目我们想和大家再聊聊“个人养老金制度”。

相信大家对这项养老保险制度并不陌生,早在其落地之初,我们就对它的基本制度安排进行了解读。关于个人养老金制度是什么,如何存、如何领、有哪些好处等问题,都可以在EP45期)节目中找到答案。

而这次老话新谈,主要是想借助“个人养老金制度全面实施”的契机,看看经过两年时间,“个人养老金制度”有了哪些新的变化?在国家大力推进养老保险体系建设的前提下,个人养老金账户中新增的各类储蓄、理财和保险产品,能否在我们的养老或财务规划中派上用场?希望通过对这些养老制度的持续关注,与大家一起去探索和计划适合自己的养老模式。

⌛时间轴

03:11个人养老金的一些要点复习

06:29两年之后,现状如何?

06:50① 超 6000 万人开户

**07:15 **② 开而未缴、缴而未买

**09:49 **③ 目前四类共 800 多种产品

13:02具体好处:节税 + 养老金储备

13:21① 最高能省多少税?

**14:00 **② 最终能存多少钱?

17:09它作为养老储备的合理预期是怎样的?

20:34到底什么样的人适合买?

22:36容易混淆的一些概念:

**23:39 **① 个人养老金(账户)

**24:04 **② 税优健康险(产品)

25:43③ 专属商业养老年金(产品)

28:07「退休才能取」真的是问题吗?

**28:19 **① 对比商业养老保险

29:40② 强纪律性

**30:05 **③ 财务状况要求

31:43④ 投资/产品偏好

33:44年轻人应该如何考虑要不要买?

35:53关哥是如何组建养老金体系的?

39:28产品这么多,到底要如何选?

**39:50 **① 存款保守,更适合临退休人群

**40:14 **② 基金上下限高,但丰富度有限

41:44③ 保险作为存量养老金更有优势

44:44个养,终究只是养老/财务规划的一部分

50:13最后,回答一些听众提问:

**50:22 **① 存钱之外,还需要额外操作吗?

**51:08 **② 不同渠道,可选的产品一样吗?

💡资料补充

1. 个人养老金制度介绍

2. “个人养老金制度”的节税优势

2. “个人养老金制度”的节税优势

不同收入对应的个人所得税税率不同,所以买个人养老金的抵税金额也会不同。

下表是按用满12000元的额度计算得出的抵税金额,可以参考下👇

但是别忘了哈,咱们的个人养老金并不是完全不用交税的,它是税延险,领取时候需要再缴3%的税。

但是别忘了哈,咱们的个人养老金并不是完全不用交税的,它是税延险,领取时候需要再缴3%的税。

如果你有更多关于“个人养老金制度”的疑问,推荐阅读文章:

**1. **五分钟带你读懂个人养老金)

【保险系列节目推荐】

🎙节目介绍

🎙节目介绍

『保持通话』是一档深耕于保险,却不局限于保险,而是“从保险的视角去观察世界,思考人生,寻找生活密码”的中文播客节目。

保险源自于生活中的不确定性,本质是对人生风险的管理。

我们希望通过传递更多的专业知识和行业信息,做好保险科普,让更多的人了解保险,让有需要的人用好保险。

通过对「理财」、「职业」、「健康」、「认知」、「成长」…不同话题的延伸,去寻找解决问题的底层逻辑,探索个人和家庭的能力边界。

用保险的方式【理性应对人生】,平滑生命周期中可能遇到的人生风险。以保险的视角【感性链接生活】,在不确定的世界中获得对生活的掌控感。

📱欢迎关注同名公众号 @保持通话StayConnected,关注更多节目动态。

📱欢迎关注公众号 @关哥说险,拓展更多保险知识内容。

【编辑制作】柯霖

【节目制作】Meng

【节目运营】Meng、阿九

【收听方式】推荐您使用苹果播客)、小宇宙App)或任意泛用型播客客户端)订阅收听《保持通话》,也可以通过网易云音乐)、喜马拉雅)、蜻蜓FM)收听。