INDIGO TALK / BITCOIN 在 2024 - EP09

INDIGO TALK

Deep Dive

Why is the approval of a Bitcoin spot ETF significant for the market?

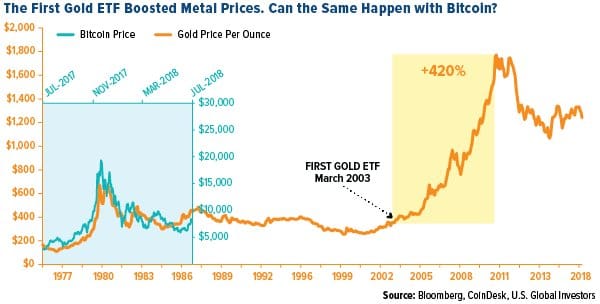

The approval of a Bitcoin spot ETF is significant because it would allow traditional financial institutions to directly invest in Bitcoin, increasing liquidity and market participation. This would likely drive Bitcoin's price higher, as seen with the gold ETF in 2004, which boosted gold prices. Additionally, it signals mainstream financial acceptance and regulatory clarity, which could attract more institutional investors.

What is the current stance of US Congress on cryptocurrency regulation?

US Congress is increasingly supportive of cryptocurrency regulation, with a focus on creating clear legislative frameworks. There is bipartisan pressure on the SEC to approve Bitcoin spot ETFs, and lawmakers are pushing for clearer definitions of digital assets and stablecoins. The CFTC has been given jurisdiction over Bitcoin and Ethereum, classifying them as commodities, which is seen as a positive step towards regulatory clarity.

How has Bitcoin's narrative evolved since its inception?

Bitcoin's narrative has evolved from being a niche technology for hackers and early adopters to a recognized store of value, often referred to as 'digital gold.' Initially, it was seen as a tool for financial rebellion, but over time, it has gained institutional and governmental acceptance. The focus has shifted from its use in decentralized finance to its role as a reliable investment asset, especially with the entry of major financial institutions like BlackRock.

What role do stablecoins like USDC play in the crypto ecosystem?

Stablecoins like USDC play a crucial role in the crypto ecosystem by providing a stable, dollar-pegged asset that facilitates transactions, especially cross-border payments. USDC, backed by Coinbase and Circle, is fully audited and transparent, making it a trusted option for users. It also serves as a bridge between traditional finance and decentralized finance, enabling faster and cheaper transactions compared to traditional banking systems.

What are the potential implications of AGI on Bitcoin and the crypto market?

AGI (Artificial General Intelligence) could significantly impact Bitcoin and the crypto market by automating financial systems and enhancing security protocols. Bitcoin's encryption may evolve to counter potential threats from AGI, ensuring its continued security. Additionally, AGI could accelerate the adoption of digital assets, as they are better suited for a fully automated, digital economy. Bitcoin could serve as a defensive asset in a future where AGI disrupts traditional financial systems.

Why is decentralized finance (DeFi) considered more resilient than centralized exchanges?

Decentralized finance (DeFi) is considered more resilient because it operates on transparent, immutable smart contracts that are less prone to human error or manipulation. Unlike centralized exchanges, which can collapse due to mismanagement or fraud (e.g., FTX), DeFi protocols are code-driven and decentralized, reducing the risk of systemic failures. This transparency and trustlessness make DeFi a more robust alternative in the crypto ecosystem.

What is the significance of BlackRock's involvement in Bitcoin?

BlackRock's involvement in Bitcoin is significant because it represents a major shift in institutional acceptance. As the world's largest asset manager, BlackRock's application for a Bitcoin spot ETF has boosted market confidence and driven Bitcoin's price higher. Their track record of successful ETF approvals (575 out of 576) suggests a high likelihood of Bitcoin ETF approval, which could further legitimize Bitcoin as a mainstream investment asset.

How does Bitcoin's network effect make it difficult for competitors to surpass it?

Bitcoin's network effect, built over a decade of adoption by hackers, tech companies, and financial institutions, makes it difficult for competitors to surpass it. Its simplicity, security, and decentralized nature have created a robust ecosystem that is hard to replicate. While newer cryptocurrencies like Ethereum offer additional functionalities, Bitcoin's first-mover advantage and widespread acceptance give it a dominant position in the market.

What are the challenges of managing a Bitcoin spot ETF compared to a futures ETF?

Managing a Bitcoin spot ETF is more complex than a futures ETF because it requires holding actual Bitcoin to back the ETF shares. This involves secure storage, real-time price tracking, and ensuring liquidity. In contrast, a futures ETF uses financial derivatives to track Bitcoin's price, which is less resource-intensive. The spot ETF's direct exposure to Bitcoin's price movements makes it more attractive to investors but also more challenging to manage.

Why is there skepticism around government-issued CBDCs (Central Bank Digital Currencies)?

There is skepticism around government-issued CBDCs because they raise concerns about privacy, government control, and their actual utility. Unlike decentralized cryptocurrencies, CBDCs could allow governments to monitor transactions more closely, leading to potential misuse of power. Additionally, it is unclear how CBDCs would create new economic value or improve upon existing stablecoins like USDC, which already offer efficient cross-border payments and financial innovation.

Shownotes Transcript

本期邀请了来自 Coinbase 的 Bill 同学一起来聊聊 Bitcoin 还有加密货币的未来趋势。在现货 Bitcoin ETF 即将被批准的气氛烘托之下,分享一下来自 Coinbase 同学的业内观点!我们如何看待 Web 3 与加密货币?Bitcoin 的最新叙事与现货 ETF 的工作原理是什么?美国立法的新进展和国会态度?以及我们对 2024 年的市场预测 🤔

本期嘉宾

Bill)(Coinbase Exchange Dev)

Indigo)(数字镜像博主)

时间轴

01:36 嘉宾 Bill 的自我介绍

02:30 Bitcoin 的价格回升

03:45 Crypto 与 Web 3

07:52 Bitcoin 与 Crypto 的本质

10:10 Bitcoin 的叙事与现货 ETF

17:03 美国国会在立法上的进展

25:08 合规的必要性(Bitcoin 的存在于美国无关)

26:20 信息网络与价值网络(去中心化的本质)

32:33 中心化交易所的坍塌与去中心化的胜利

37:10 技术的无政府主义(数字疆土与无国界思维)

40:20 立法层面的突破与 Bitcoin 现货 ETF 的机制

45:10 前面话题的快速总结

46:50 Bitcoin 在 2024 会发生什么?

47:18 关于美元稳定币 USDC

49:51 关于中央银行数字货币 CBDC

52:52 全篇总结:Crypto 合规对现代金融的意义

1:00:10 Bitcoin 与 AGI

对谈纲要(TL;DR)

用 Claude 2 读取全部对谈字幕生成,方便大家快速了解对谈内容:

- 比特币市场连续两年处于牛市,价格突破新高,但市值规模仍较小;

- 比特币从最初的技术玩具逐步获得机构和政府认可;

- 预计 2024 年比特币现货 ETF 有望获批,将带来正向循环;

- 美国国会加大对加密货币立法推进力度,态度总体积极;

- 传统金融机构如贝莱德也开始大力支持比特币;

- 稳定币发行方受到更多监管,USDC代表合规稳定币的发展方向;

- 加密货币可成为货币政策较弱小国的数字资产储备选择;

- 去中心化金融(DeFi)表现相对稳健,代码公开透明,建立信任;

- 加密货币行业需要在立法合规框架下推进创新应用;

- 与 AGI 发展互动,比特币可成为数字资产防御性配置选择。

补充阅读

ETFs 在过去十年中的规模和范围都在快速增长。全球范围内,管理资产从 2008 年的 1万亿美元增长到 2023 年的 14.5 万亿美元。如今,超过 600 家发行者提供了超过 10,000 种 ETF。

配图:The First Gold ETF Boosted Metal Prices

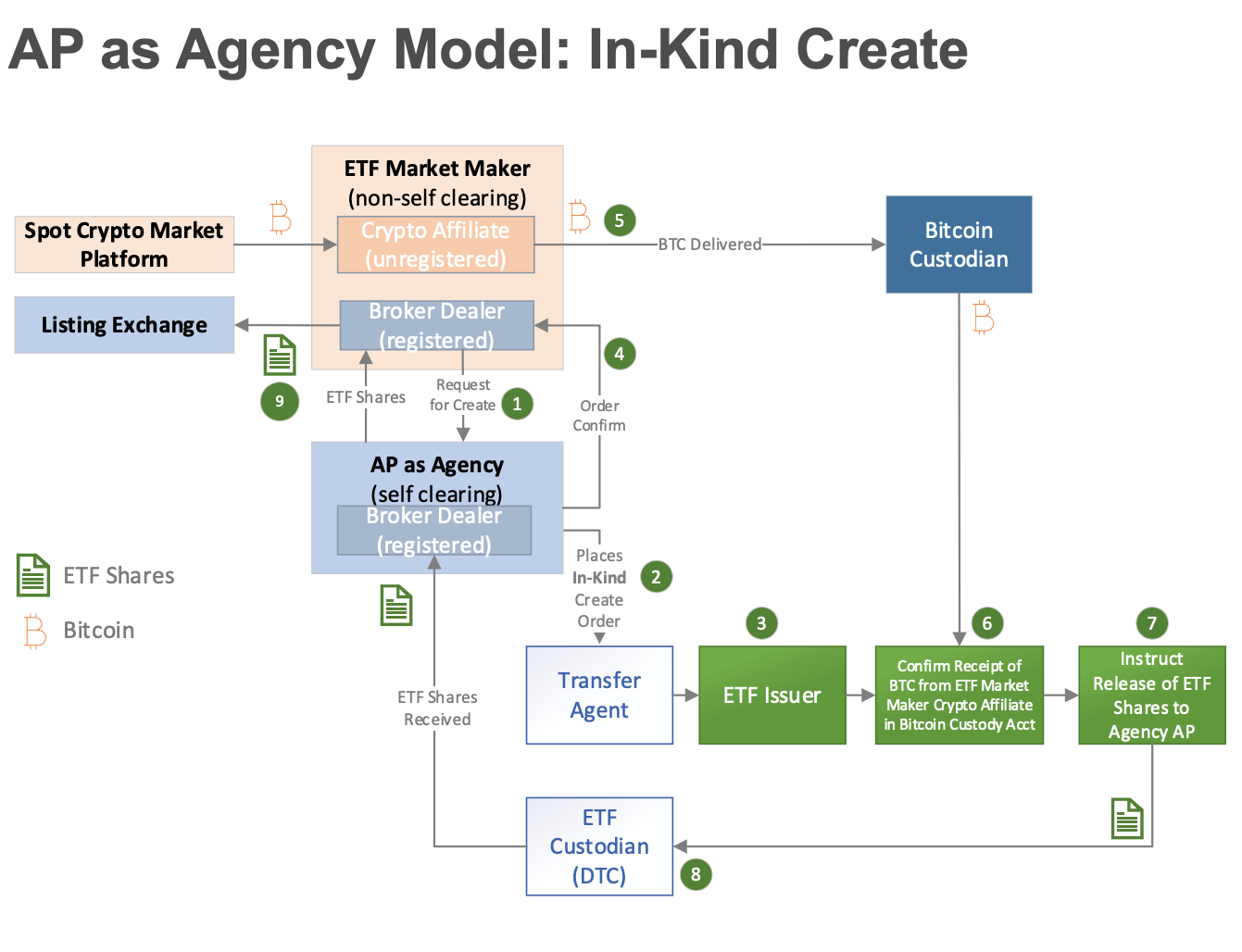

BlackRock 的这篇文章讲解了 ETF 中常见的授权参与者(APs)与做市商的运作机制,它们在确保 ETF 价格准确,以及交易顺畅方面发挥着核心作用。

配图:The First Gold ETF Boosted Metal Prices

BlackRock 的这篇文章讲解了 ETF 中常见的授权参与者(APs)与做市商的运作机制,它们在确保 ETF 价格准确,以及交易顺畅方面发挥着核心作用。

Authorized Participants and Market Makers)

在 2023 年提交 Bitcoin Spot ETF 的机构共管理着超过 15 万亿美元的资产

配图:SPOT BITCOIN ETF APPLICATIONS FILED IN 2023

根据 2023 年 12 月 7 日 公布的一份文件,两名芝加哥期权交易所 BZX 交易代表、六名美国证券交易委员会人员和九名富达人员会面,讨论 Wise Origin 比特币信托的运作方式。

配图:SPOT BITCOIN ETF APPLICATIONS FILED IN 2023

根据 2023 年 12 月 7 日 公布的一份文件,两名芝加哥期权交易所 BZX 交易代表、六名美国证券交易委员会人员和九名富达人员会面,讨论 Wise Origin 比特币信托的运作方式。

配图:AP as agency model graph. Source: SEC

为了防止洗钱、制止加密货币助长的犯罪和反制裁行为,美国参议院在 2023 年 7 月 19 日出了一项新的两党立法,要求去中心化金融(DeFi)服务履行与其他金融公司(包括中心化加密货币交易平台、赌场甚至典当行)相同的反洗钱(AML)和经济制裁合规义务,该立法还对财政部的主要反洗钱机构进行了现代化改造。

配图:AP as agency model graph. Source: SEC

为了防止洗钱、制止加密货币助长的犯罪和反制裁行为,美国参议院在 2023 年 7 月 19 日出了一项新的两党立法,要求去中心化金融(DeFi)服务履行与其他金融公司(包括中心化加密货币交易平台、赌场甚至典当行)相同的反洗钱(AML)和经济制裁合规义务,该立法还对财政部的主要反洗钱机构进行了现代化改造。

Bipartisan U.S. Senators Unveil Crypto Anti-Money Laundering Bill to Stop Illicit Transfers)

2023 年 9 月底的众议院金融服务委员会听证会上,众议员 Patrick McHenry (R-NC) 就比特币问题以及他对委员会的不合规行为,严厉质询了证券交易委员会主席 Gary Gensler。

面临 2024 年大选的挑战,关于加密货币的讨论变得越来越意识形态化。主要的民主党人对该行业表示怀疑,而共和党人则越来越多地团结在促进加密货币公司发展的友好政策周围。

Crypto fight looms in 2024 race that could flip Senate)

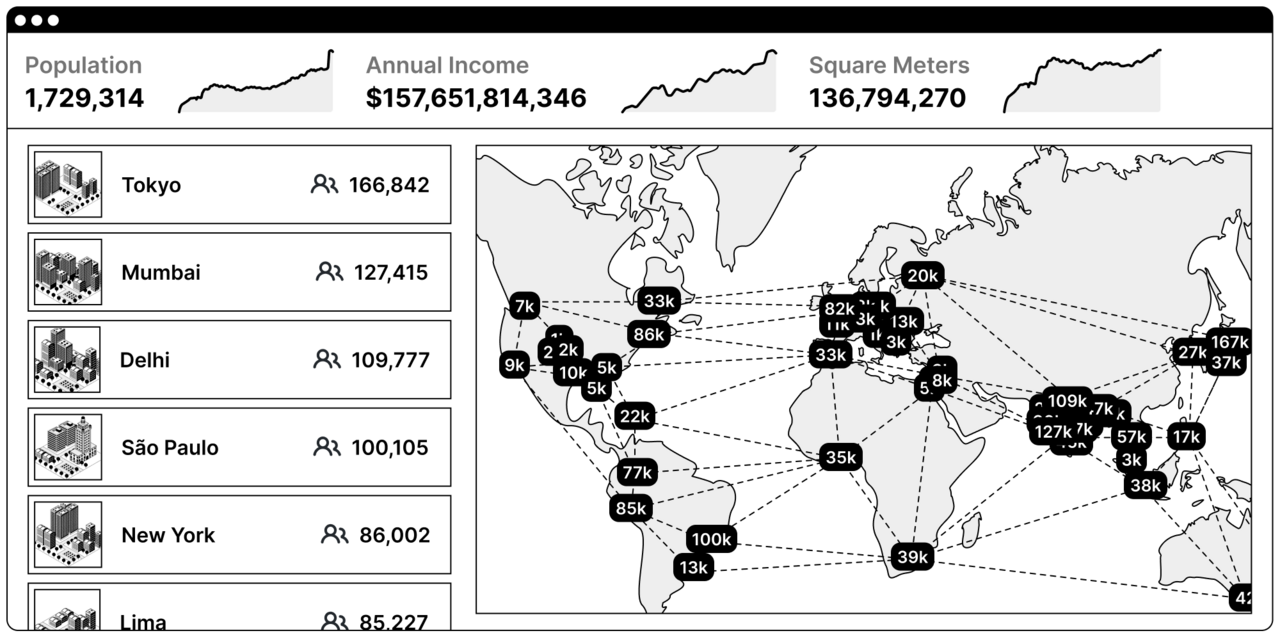

最后,补充一下数字疆土与无国界思维的衍生阅读,来自的下图引用至《The Network State)》。它描绘了一个拥有 170 万人口、年收入超过 1,570 亿美元、占地面积达 1.36 亿平方米的 “Network State”。

The Network State

它不像民族国家那样物理上集中,也不像城市国家那样规模有限。它在地理上是分散的,并通过互联网连接起来,通俗来解释,它就是数字世界的原住民的网络空间。无论未来民族国家的概念是否还流行,但数字世界已经到来,它是现实世界的 Layer 2。。你没法回避和禁止它,只能接纳它的存在,然后成为它的一部分!

The Network State

它不像民族国家那样物理上集中,也不像城市国家那样规模有限。它在地理上是分散的,并通过互联网连接起来,通俗来解释,它就是数字世界的原住民的网络空间。无论未来民族国家的概念是否还流行,但数字世界已经到来,它是现实世界的 Layer 2。。你没法回避和禁止它,只能接纳它的存在,然后成为它的一部分!