Deep Dive

Why did the Japanese stock market experience a significant drop on August 5th?

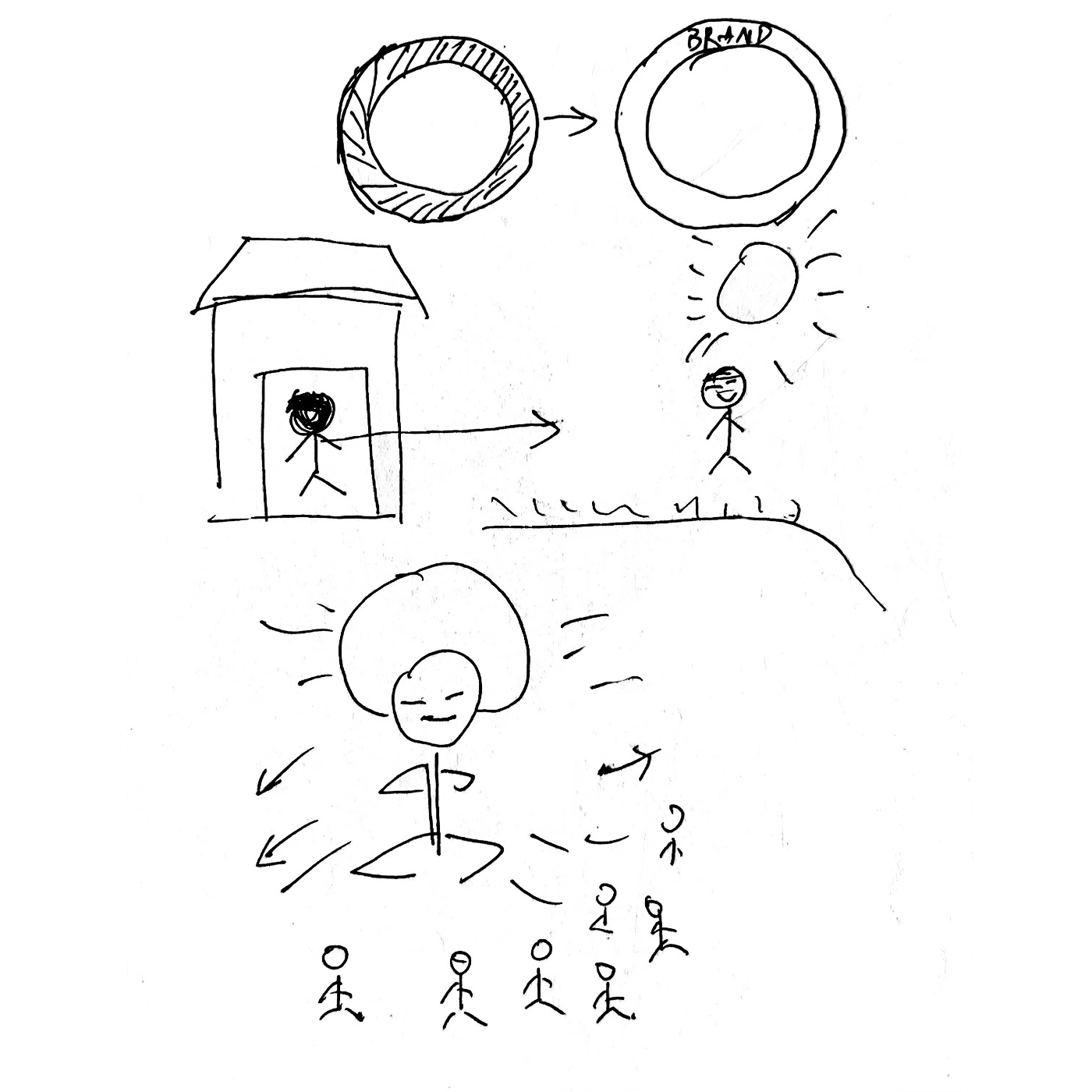

The Japanese stock market, specifically the Nikkei 225 index, dropped by 12.4% on August 5th, marking one of the largest single-day declines in its history. This drop was primarily due to the market being in a highly overvalued state, with the Nikkei 225's price-to-earnings (P/E) ratio reaching around 17 times by late April, close to its historical high of 18 times. The market had been driven up by speculative and non-professional investments, including foreign retail investors, rather than institutional investors with strong profit records.

What factors contributed to the recent appreciation of the Japanese yen?

The recent appreciation of the Japanese yen can be attributed to several factors, including the unwinding of carry trades where investors borrowed low-interest yen to invest in higher-yielding assets like U.S. stocks. As U.S. stocks fell, these investors sold their holdings and bought back yen to repay their loans, increasing demand for the yen. Additionally, the Bank of Japan's unexpected rate hike of 15 basis points in late July and a more hawkish stance than previously anticipated also contributed to the yen's strength.

How does the valuation of the U.S. stock market compare to historical norms?

The U.S. stock market, particularly major tech companies like Apple and Nvidia, has reached high valuation levels. Apple's P/E ratio was around 32 times, and at its peak in July, it was 35 times, which is significantly higher than the typical high valuation range of 15 to 20 times for stable companies. Nvidia's dynamic P/E ratio, even after assuming a doubling of this year's earnings, was around 60 times, far exceeding the reasonable range of 8 to 15 times for a stable company. These high valuations suggest that the U.S. stock market is in a bubble phase.

What is the significance of Warren Buffett's recent sale of Apple stock?

Warren Buffett's sale of Apple stock, which began in the second half of last year and continued into this year, indicates his view that Apple's stock was overvalued. By the time of the sale, Apple's P/E ratio had reached around 32 times, which is high for a company with stable but no growth earnings. Buffett's decision to sell, despite citing tax reasons publicly, aligns with his investment philosophy of selling overvalued assets, suggesting a cautious stance on the current valuation levels of major U.S. tech stocks.

- 日经R5指数单日下跌12.4%

- 日元对美元快速升值

- 美股持续回调

- 日本股市高估值

- 投机性资金推高股市

Shownotes Transcript

添加微信waibuxing为好友,可以领取一份投资推荐资料书单。

主播

李铁ironlee

外部性付费内容合集

会员文章)

节目公众号

外部性(部分单集的播客文字稿可以关注公众号获取)

结尾音乐由我的朋友王儒西制作