Deep Dive

What are some unusual claims Judy has encountered in her insurance career?

Judy has encountered claims involving children swallowing magnets, which can be very dangerous as they can cause intestinal blockages. She also mentioned cases of children being bitten by insects, leading to severe swelling and hospital visits. Another unusual claim involved a child who dislocated their jaw while eating a bone.

Why is it important to understand the difference between medical and insurance underwriting?

Understanding the difference is crucial because clients often misunderstand why their medical condition, deemed fine by doctors, leads to higher insurance premiums or exclusions. Medical underwriting focuses on the risk of future claims, while clinical medicine assesses current health. This distinction helps explain why insurers might view a condition differently from a doctor.

What is the significance of belief in the insurance sales profession?

Belief is essential in insurance sales as it helps agents confidently convey the value of products to clients. For instance, Judy initially struggled to explain the importance of pension insurance but, after understanding and believing in its benefits, she could effectively communicate its value. This belief fosters trust and helps clients see the product's relevance to their needs.

How does Judy describe her approach to handling small insurance claims?

Judy emphasizes the importance of not dismissing small claims, such as low-budget medical insurance, even if they are less profitable. She believes in serving every client diligently, as neglecting them could compromise her professional integrity and disrupt her workflow. This approach ensures she maintains her ethical standards and client trust.

What challenges do new insurance agents face when transitioning from other industries?

New agents often struggle with the shift from a performance-driven, results-oriented mindset to a service-oriented one. In industries like tech, success is measured by quantifiable outcomes, but in insurance, success comes from building trust and providing personalized service. This transition requires adapting to a more client-focused approach and understanding the long-term nature of the business.

What is the role of 'meritocracy' in the insurance industry?

Meritocracy in insurance differs from other industries as it doesn't solely reward the 'best' performers based on linear metrics. Instead, success in insurance is multifaceted, involving factors like trust, client relationships, and personalized service. This approach allows for diverse paths to success, rather than a single, rigid standard of excellence.

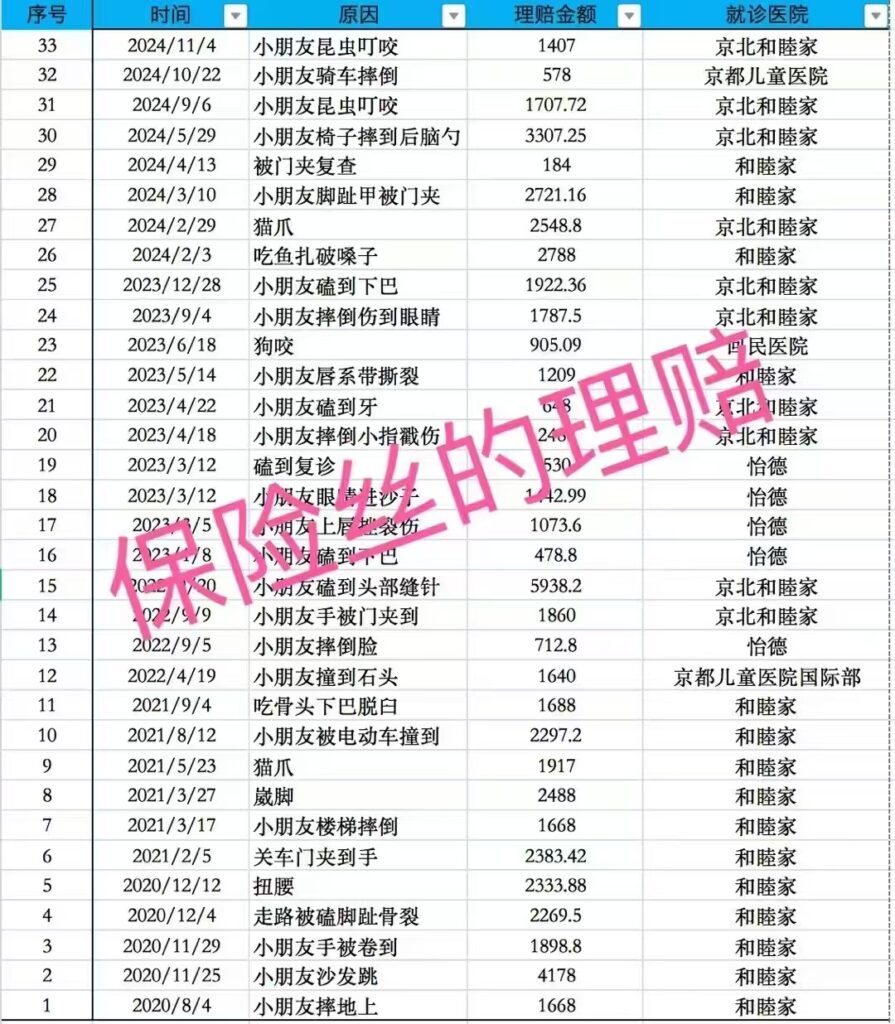

- 理赔案例涵盖了儿童意外伤害、成人意外伤害等多个方面。

- 许多理赔案例看似微不足道,但却真实发生,并获得赔付。

- 意外险理赔范围广泛,涵盖了各种意想不到的情况。

Shownotes Transcript

2025年的第一期节目!

这期和德福的两位优秀同事,也是人间自由指南)的主播相约了串台!节目的前半段我们聊了从业生涯中遇到的各种意外事件,之后各自分享了人生的小概率事件,最后我们从初心到信念探讨了保险的职业发展。

Judy曾经是我们节目早期很想要约的嘉宾,今天我们也聊了「念念不忘,必有回响」。(虽然这期一点关于重疾险的正事也没聊)

过去一年里,无论是和嘉宾们,还是听友们的不期而遇,和一些嘉宾成为了朋友,一些听友成为了客户,还有一些听友成为了嘉宾的客户(含泪恭喜)。在让自己开心一点,和让保险行业变好一点这两个目标上都取得了很大的胜利。

新的一年,我们会努力继续保持周更,把更多保险知识和更多有趣的保险人介绍给大家,希望可以有机会成为大家信赖的顾问,甚至成为同路的伙伴。

【嘉宾介绍】

一丝 (微信 wenyisi002)

人间自由指南)主播|保险代理人|27岁成为大厂副总裁助理|前大厂运营专家|三次跨行职业经历

Judy(微信:zjsbird)

人间自由指南)主播|保险代理人|北大本科|宾大硕士|乳腺癌女战士|保险理赔上百万|百万圆桌TOT|前4A品牌营销高管|小红书:Judy是朱迪迪)|公众号【 琐琐说】

汤圆(微信:tangyuanyuan)

保险经纪人/悉尼大学硕士/公众号【汤圆圆的土豆世界】/爱这个美丽的世界!

德福【团队招募中…】(微信:nemo611)

保险代理人/前滴滴资深工程师/知乎优秀答主/目前养育一个人类幼崽)

【时间轴】

06:58 一丝赔付过的奇特意外险

12:15 小朋友都能吃什么奇怪的东西

20:09 汤圆拼车遇到了正在听的歌的主唱

24:05 一丝看电影被人认出来搭讪

28:21 世界很神奇,每个人都会认识每个人

36:52 德福其实在社交中非常被动

38:51 汤圆的「粉头」经历

43:02 Judy的在美国偶遇中学学弟

46:26 好的销售和好的演员一样需要信念感

50:36 汤圆做保险行业的初心

54:32 保险代理人和互联网工作的最大不同

57:46 优绩主义的框架对人的限制

59:33 我们的嘉宾居然是友邦Top1 Sales

64:12 那不是我的黑历史,那是我的来时路

72:54 兼职做保险还是全职做保险本身就是一个伪命题

【参考资料】

一个癌症病人的保险意见)

推荐不伤手的快递刀

推荐不伤手的快递刀

【其他串台】

不太保险 X 聊到没电:延迟法定退休年龄改革:65岁退休35岁失业,未雨绸缪)

德福 X 科技乱炖:真去送了外卖的程序员,来聊聊他眼中的《逆行人生》)

德福 X Web Woker:No.63 德福的逆行人生:不会送外卖的保险代理人不是一个好前端 – Web Worker-前端程序员都爱听)