The Race for AI—Search, National Infrastructure, & On-Device AI

a16z Podcast

Deep Dive

2025:AI竞赛的转折点

2025年,人工智能将迎来一个变革的时代。我与a16z的合伙人们——Anjney Midha、Jennifer Li和Alex Immerman——深入探讨了重塑AI格局,并影响搜索、基础设施和设备的几大趋势。

搜索引擎垄断的终结?

Alex Immerman指出,谷歌对美国搜索市场的垄断地位(90%的市场份额)正在动摇。 反垄断诉讼以及生成式AI的兴起,为其他搜索引擎提供了机会。ChatGPT拥有2.5亿周活跃用户,Perplexity月增长率达25%,其平均查询长度是谷歌的三倍,且近半数查询会引发后续问题。 Claude、Grok、Meta.ai和Poe等聊天机器人也在蚕食谷歌的市场份额。消费者对AI驱动的搜索引擎的接受度很高,60%的美国消费者在过去30天内使用聊天机器人进行产品调研或决策。专业人士则开始使用Causally、ConsenSys、Harvey和Hebbia等垂直领域AI工具进行深入研究。

谷歌的传统搜索模式——链接列表——已不再满足用户对直接答案和深入信息的渴望。虽然谷歌自身也能提供AI搜索结果,但这会牺牲短期利润。 “谷歌”作为动词的含义正面临挑战,一场新的搜索引擎竞争已经打响。 虽然搜索市场规模巨大(谷歌年收入接近2000亿美元),但AI原生服务的崛起,以及个性化、互动性和对复杂查询的处理能力,正在改变竞争格局。垂直化搜索引擎,凭借其特定用户界面、专有数据和工作流程,将在特定领域获得发展。尽管网络效应和品牌效应依然重要,但整合和垂直化并存的局面将成为未来搜索市场的新常态。

AI基础设施的独立性:国家战略的博弈

Anjney Midha 认为,计算能力已成为AI竞争的关键国家基础设施。各国政府面临着“自主建设还是购买”的抉择。对于小型国家而言,与AI技术领先国家(他称之为“超中心”)建立合资企业,是获得AI基础设施的有效途径。 AI模型中编码的人类价值观,决定了小型国家需要选择与自身价值观相符的“超中心”合作。 这一选择与历史上各国对货币体系的选择类似,小型国家可以效仿新加坡、爱尔兰等国家,成为AI基础设施领域的枢纽。

建设AI基础设施需要考虑计算能力、能源、数据和法规四个要素。各国应发挥自身优势,例如中东国家可以利用丰富的能源储备吸引全球顶尖人才和企业。 完全的独立性在短期内难以实现,关键在于确保关键环节的独立性,并与其他国家或企业合作。 美国在AI发展中面临数据监管不统一、能源政策限制以及责任不明确等问题。 关注各国对GPU的采购以及能源中心建设情况,可以判断其在AI领域的竞争力。 那些既具备深厚技术背景,又具有强烈使命感的AI领域创始人,将对推动AI发展至关重要。

设备端AI:隐私、性能与新应用的融合

Jennifer Li 指出,小型设备端生成式AI模型将在未来几年变得更加流行。智能手机的计算能力不断提升,小型AI模型也越来越高效,这使得设备端运行AI模型成为可能。 在设备端运行AI模型的优势在于能够提升用户体验、提高效率以及保护用户隐私。 实时语音代理、增强现实(AR)等应用场景将成为设备端AI模型的重要应用领域。 设备端AI模型可以改变用户与物理世界的交互方式,例如重新定义AR体验。 虽然设备端AI模型的运行成本可能不会大幅降低,但它将改变开发效率和迭代速度,并惠及整个供应链,包括芯片制造商和模型开发者。 混合现实技术将是未来AI发展的一个重要方向。

结语

2025年,AI技术将深刻地改变搜索、基础设施和设备领域。 搜索引擎市场将面临整合与垂直化并存的局面;各国政府需要在AI基础设施建设中权衡自主与合作;设备端AI将带来更便捷、高效和私密的应用体验。 这将是一个充满机遇和挑战的时代,需要我们积极应对,抓住机遇,引领未来。

Why is Google's search dominance under threat in 2025?

Google's search dominance is under threat due to the rise of AI-native tools like ChatGPT and Perplexity, which offer more personalized, conversational, and ad-free experiences. Additionally, Google faces legal pressure from antitrust rulings and competition from alternative search providers empowered by phone manufacturers like Apple. AI-driven search engines like Perplexity are growing 25% month-over-month, and 60% of U.S. consumers used chatbots for purchase decisions in the last 30 days.

What are the key differences between traditional search engines and AI-native search tools?

AI-native search tools like ChatGPT and Perplexity provide immediate answers instead of lists of links, offer personalized and conversational interactions, handle complex queries better (average query length is 10-11 words compared to Google's 2-3 keywords), and are less cluttered with ads. These tools also encourage follow-up questions, making the search experience more interactive and engaging.

Why are smaller, on-device AI models becoming more popular?

Smaller, on-device AI models are gaining popularity due to their ability to deliver real-time, performant experiences without relying on cloud infrastructure. They enhance user privacy by processing data locally, reduce latency for applications like voice agents and AR experiences, and leverage the increasing compute power of modern smartphones, which are now as powerful as computers from 10-20 years ago.

How are nation states approaching AI infrastructure independence?

Nation states are prioritizing AI infrastructure independence by deciding whether to build or buy AI capabilities. Smaller countries often enter joint ventures with hypercenters (countries with advanced AI infrastructure) to align with shared values and access compute resources. Key ingredients for AI infrastructure include compute capacity, abundant energy, high-quality data, and forward-thinking regulation. Countries like the U.S. and China are leading in building sovereign AI, while others focus on leveraging their strengths, such as energy reserves, to attract AI development.

What challenges does the U.S. face in maintaining its AI leadership?

The U.S. faces challenges in maintaining AI leadership due to fragmented data regulation, with over 700 state-level AI-specific laws in 2024 alone, many of which are poorly implemented. Additionally, the U.S. has lagged in nuclear energy adoption, which is critical for powering data centers, and lacks a unified federal framework for AI data regulation. This regulatory uncertainty hampers innovation and risks driving AI developers to other countries with clearer guidelines.

What role do private companies play in national AI infrastructure?

Private companies play a significant role in national AI infrastructure by driving innovation and providing critical technologies. In the U.S., companies like NVIDIA and OpenAI lead in compute and AI model development, while in China, private companies are legally required to support national intelligence efforts. The balance between government oversight and private sector freedom varies by country, but unlocking private sector talent with minimal bureaucratic hurdles is key to maintaining AI leadership.

What are the potential applications of on-device AI models?

On-device AI models can power real-time voice agents, enhance AR experiences, and improve user interactions with applications like Uber, Instacart, and social media platforms. They enable faster, more private processing of tasks like voice conversations, image filters, and real-time pricing, while also supporting creative applications like virtual interior design and interactive 3D experiences.

How does the economics of on-device AI differ from cloud-based AI?

On-device AI reduces reliance on cloud infrastructure, potentially lowering inference costs and improving user experience through lower latency. However, the economics are not straightforward, as cloud inference prices have been dropping significantly. On-device models require careful integration with hardware updates, which can impact developer efficiency and iteration speed. The shift to on-device AI may benefit hardware manufacturers and chip developers like NVIDIA in the long run.

Shownotes Transcript

The AI race is on, and 2025 could be its most transformative year yet.

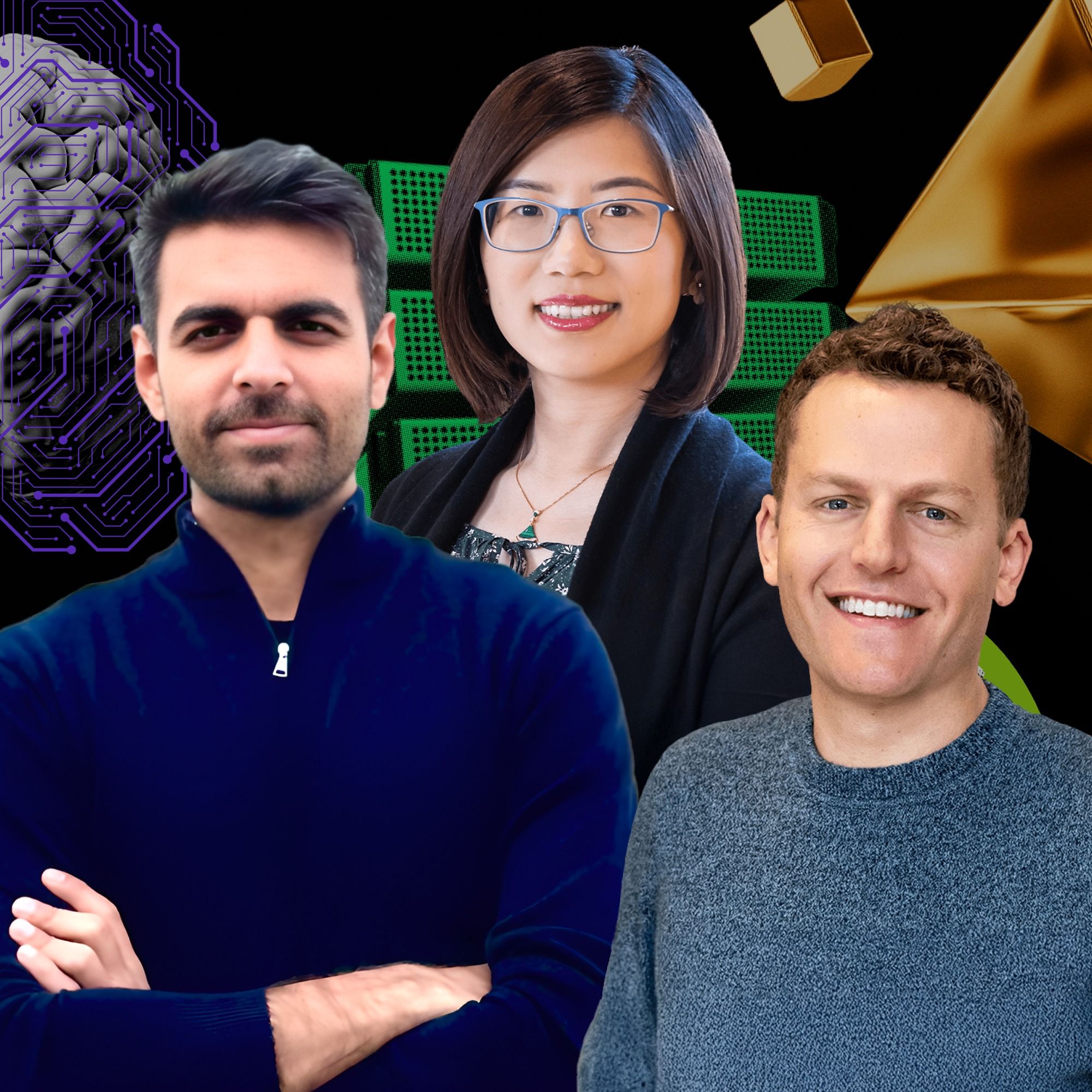

In this episode, a16z General Partners Anjney Midha and Jennifer Li, and Partner Alex Immerman dive into the trends reshaping AI and its impact on search, infrastructure, and devices.

We explore:

- How AI-native tools like ChatGPT and Perplexity are challenging Google’s search dominance.

- The rise of infrastructure independence as governments prioritize compute, energy, and data.

- The future of smaller, on-device AI models driving privacy, performance, and new consumer applications.

With insights from a16z’s Growth and Infrastructure teams, this episode unpacks the forces driving AI innovation—and the opportunities founders and nations could seize to lead in the next wave of technology.

Stay tuned for more in this four-part series, and explore the full 50 Big Ideas for 2025 at a16z.com/bigideas.

Resources:

Find Alex on X: https://x.com/aleximm

FInd Anjney on X: https://x.com/AnjneyMidha

FInd Jennifer on X: https://x.com/JenniferHli

Stay Updated:

Let us know what you think: https://ratethispodcast.com/a16z

Find a16z on Twitter: https://twitter.com/a16z

Find a16z on LinkedIn: https://www.linkedin.com/company/a16z

Subscribe on your favorite podcast app: https://a16z.simplecast.com/

Follow our host: https://twitter.com/stephsmithio

Please note that the content here is for informational purposes only; should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security; and is not directed at any investors or potential investors in any a16z fund. a16z and its affiliates may maintain investments in the companies discussed. For more details please see a16z.com/disclosures.