Paying out of pocket for breast cancer screenings

Marketplace Morning Report

Deep Dive

- Stock market reaches all-time highs despite policy uncertainty

- China framework officially signed

- Tariff deadline extensions expected for countries negotiating in good faith

- Fed's inflation indicator slightly higher than expected but within acceptable range

Shownotes Transcript

Thank you.

How those ahead said stay ahead.

It's called protein degradation. And if you're a bad protein in a cancer cell, you'd better get your affairs in order. Because now, thanks to Dana-Farber's foundational work, protein degradation can target cancer-causing proteins and destroy them, right inside the cell. This take-no-prisoners approach is making a difference in multiple myeloma and other blood cancers, and is how Dana-Farber is working to treat previously untreatable cancers.

Learn more at danafarber.org slash everywhere. A record high stock market. I'm David Brancaccio in Los Angeles. First, business leaders complain of all the policy uncertainty forcing them to put decisions on hold, but the stock market is anticipating profits. Just now, the S&P and the Nasdaq indexes started trading at all-time highs. On

On Friday, we turn to Christopher Lowe, chief economist at FHN Financial in New York. Hey, Chris. Good morning, David. First of all, stock market, some of the index's new all-time highs. Despite all this uncertainty, what do you make of this? Well, according to traders who've talked to the press, they're excited because

The China framework was announced yesterday. Now, bear in mind, this is the same China framework that was announced weeks ago, the one they negotiated in London. What happened yesterday was all the necessary bureaucrats in both countries finally signed off on it. So it's official. I think it's a bit of excitement maybe over old news.

Although Howard Lutnick, the Commerce Secretary, did add that he thinks we're very close to deals with 10 other countries. Yeah, that's interesting. You also had the White House chief economic advisor, Stephen Mirren, telling Yahoo Finance that he expects countries will get extensions past the July 9th tariff deadline if those countries have been negotiating trade with the U.S. in earnest. Yeah.

You know, honestly, maybe that's really the most important thing because it means, you know, that that deadline clock is ticking. The pause is about to end. And it means the average tariff rate is not going to kick all the way back up to where it was on April 2nd. And that's really important.

And briefly, we got the Fed's preferred inflation indicator today, personal consumption expenditures, terrible name. It was up just a sliver more than expected, but it didn't look out of whack. No, it's not bad. And remember, too, the Fed policy is positioned for the worst case scenario, not their expected scenario. So a little bit higher than expected, that's plenty good enough to meet their strict demands.

Christopher Lowe, Chief Economist, FHN Financial. Thank you. Thank you, David.

Thank you.

With no cost to join, you can register, browse freelancer profiles, and get help drafting a job post or even book a consultation. From there, you connect with freelancers that get you and can easily hire them and take your business to the next level. Visit Upwork.com right now and post your job for free. That's Upwork.com to post your job for free and connect with top talent ready to help your business grow. That's U-P-W-O-R-K.com. Upwork.com.

Crude oil is up eight-tenths percent now, still under $66 a barrel. One way to know it's business as usual, that kind of day through the narrow stretch of water between Oman and Iran, the Strait of Hormuz. It's a low oil price that suggests the Israel-Iran ceasefire is holding for now. Our colleague and our partner at the BBC, Samir Hashmi, reports from Dubai. For nearly two weeks, Iran and Israel were locked in their most intense conflict in decades.

And for a few hours, it felt like the Gulf was on the brink. One of the biggest fears? That Iran might block the Strait of Hormuz, one of the world's most important shipping routes and its most vital oil transit chokepoint, with nearly 20% of the world's oil passing through it. Ben Cahill is an energy expert at the Center for Strategic and International Studies.

He says Iran closing the strait was never a likely scenario. The full closure of the strait would cut off Iran's critical source of export revenues, foreign currency revenues. And that's definitely not in the interest of the Iranian state or the oil sector. So that would be a major reason why Iran would not decide to go for a full-scale closure of the strait. And no matter what happens in the months to come, I mean, Iran will be highly dependent on oil revenues. But it wasn't just oil that was affected.

I'm standing right now at Dubai Creek, the heart of all Dubai's trading routes. But now this place has become more symbolic than strategic. But just a few kilometres away from here sits Jabal Ali, the largest port in the Middle East and one of the busiest in the world. Over the last few decades, Dubai has emerged as a major global trade hub, connecting Asia, Africa and Europe. But the recent Israel-Iran conflict...

threatened to disrupt that rhythm. Average container shipping rates jumped by 55%. Rashman Manoli is the vice president of freight forwarding at Consolidated Shipping Services, one of Dubai's largest freight companies. At the moment, it's still fluid. Everybody's waiting and watching how things unfold.

And the prices that go up, do they immediately come down or does it take some time then for the prices to gradually settle down? It gradually settles down. Initial impact is when you have a choke point and when you have a situation of backlogs, obviously the vessels will need to be diverted to other ports and then moving those containers from those transshipment ports back into UAE, that's additional cost. So yes, if there is a long term, then the prices will continue to be long term.

Throughout the conflict, Gulf states tried desperately to avoid being dragged in. The region also houses some of the world's largest oil and gas facilities, infrastructure that has been targeted in past attacks. Since then, Saudi Arabia and the UAE have worked to thaw relations with the Iranian regime, even as they have deepened security ties with the United States.

Badr Al-Saaf, a Gulf-based geopolitical analyst and a professor at the Kuwait University, believes that the recent conflict will push Gulf states to double down on improving ties with Tehran. Look, the Gulf states have been pursuing a nimble foreign policy that caters to fast-changing dynamics, that advances their security, their national interests, that also advances their domestic needs. And those plans require peace and stability.

In a region trying to chart a new course away from oil towards innovation and growth, stability is currency. In Dubai, I'm the BBC's Samir Hashmi for Marketplace.

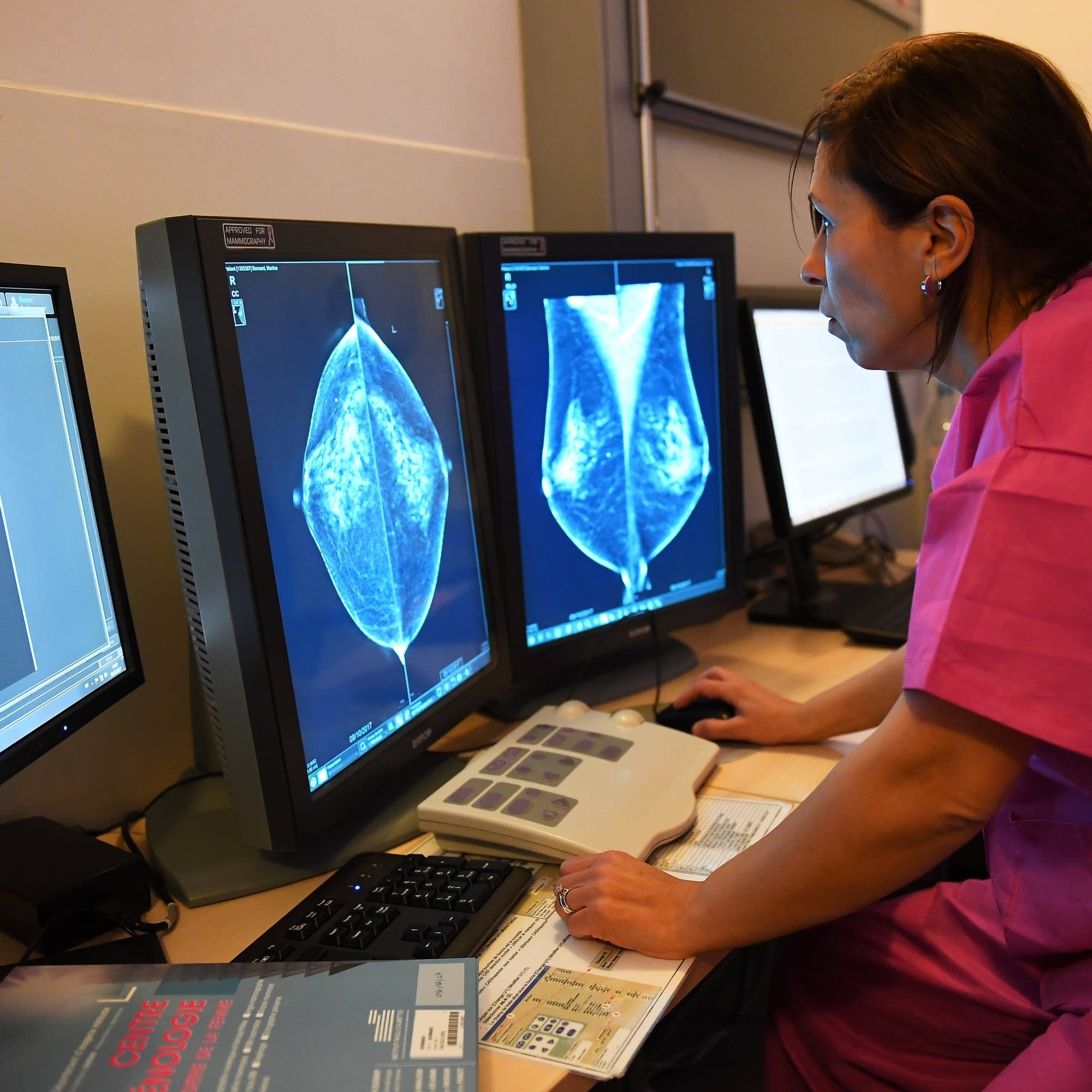

Early detection of breast cancer is the key. Those 40 and older can get annual mammograms paid for by their health insurance, but for roughly half, mammograms have a harder time detecting cancer. They have dense breast tissue that requires additional screening, and that extra screening is not always covered by insurance. Reporter Golda Arthur has more. Most women find out they have dense breast tissue when they get their mammogram results lettered.

New Yorker Michaela Birmingham found out a couple of years ago. The letter did explain that it's common and that you just have to, you know, follow the proper recommended checkups to make sure that nothing's missed. Mammograms can miss signs of cancer in dense breasts. The tissue shows up as white and so do any tumors. Birmingham follows up with ultrasounds, which are more accurate, and says she's lucky her insurance company pays for that additional screening. But

But not everyone's that lucky. Definitely people fall through the cracks. Dr. Julie Gershon is a Connecticut radiologist in private practice. The screening ultrasound should be considered a medical necessity for screening for breast cancer. But Dr. Gershon says not all insurers agree. She frequently has to get into a back and forth with insurance companies about getting those ultrasounds paid for. We just did invoices last week and already I have

Two patients calling me about why their screening ultrasounds weren't paid for. Those tests can cost patients more than $300 out of pocket. And if an ultrasound doesn't paint a clear picture, they could be on the hook for about $1,000 for an MRI. Rhode Island resident Jenny Hetzel Silbert says she fought her insurance company over the cost of her ultrasounds every year for three years. I filed my appeals. It was months and months of getting intimidating letters and bills.

Silber testified before the Rhode Island state legislature in 2023 on behalf of a bill aimed at forcing insurers to pay for follow-up screening. It passed, making Rhode Island one of 35 states with similar laws. Now,

Now the issue has become a conversation in Washington. Several bipartisan bills aim to help patients pay for screenings. There's reform. Congress is coming together. You don't often hear about them working together, but there are some issues that they agree on. Jessica Baladad is the founder of an organization called

feel for your life and a breast cancer survivor. Until Congress acts, her advice to people facing high out-of-pocket costs for screening is to find out what their state requires insurance companies to pay for and to stay informed on their rights as a patient. In New York, I'm Golda Arthur for Marketplace.

And a person's crypto holdings could soon help him get a federally backed home loan. The Federal Housing Finance Agency chief suggested this week that Bitcoin and the like might soon be considered when evaluating credit worthiness for mortgages through Fannie Mae or Freddie Mac. Crypto doesn't count at the moment with the view its value had less of a track record and was maybe less predictable. I'm David Brancaccio. This is the Marketplace Morning Report. We're from APM, American Public Media.

Hey there, it's Ryan, co-host of Million Bazillion, a podcast that answers your kids' big questions about money. This week, we're kicking it old school and taking questions from Million Bazillionaires in this super special show. I was wondering how much people in the government, like the president, make and how do they decide? How do airlines determine the price of a ticket? Where did the penny get its name? Plus, Bridget and I put some old cassette tapes to good use. Listen to Million Bazillion wherever you get your podcasts.