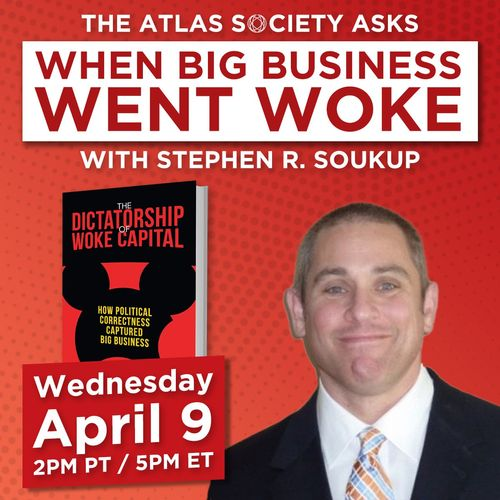

When Big Business Went Woke with Stephen R. Soukup

The Atlas Society Presents - The Atlas Society Asks

Deep Dive

- Woke capital is defined as a top-down, anti-democratic movement.

- It aims to alter American business and the relationship between shareholders and corporations.

- American voters' preferences differ significantly from the goals of woke capital.

Shownotes Transcript

Join Atlas Society International Strategy Director Isidora Kolar for the 248th episode of The Atlas Society Asks where she interviews Stephen R. Soukup about his book "The Dictatorship of Woke Capital: How Political Correctness Captured Big Business," exploring the Left’s long march through American Institutions, culminating in its capture of Big Business, and a strategy to prevent corporate America from becoming an economically powerful extension of the “woke” college campus.

Stephen R. Soukup is the senior commentator, Vice President, and Publisher of The Political Forum, an “independent research provider” that delivers research and consulting services to the institutional investment community with an emphasis on economic, social, political, and geopolitical events likely to have an impact on the financial markets in the United States and abroad.